Scaling up in VC...

From no plan to a fellow with a vision, Chen’s taken every opportunity to lap up experiences in the entrepreneurial and venture capital ecosystems. A passionate software engineer and founder, Chen was at a crossroads when his path turned to Newton Venture Program. This is Chen’s story.

Engineering a career

Growing up in China, Chen didn’t know what he wanted to do until he hit university. Something that wasn’t uncommon for a Chinese teenager. He was a highly able student and was fast-tracked in primary school, something that made him feel pressured at the time, particularly in high school. On graduation, a year or two ahead of everyone else, he realised the age advantage this gave him and also, his love for software engineering.

“Writing software, creating a product and starting a business seemed like the most exciting thing I could do. You create something, someone uses it, which gives you great satisfaction and it’s even better when you can make money out of it!”

Chen’s first venture was a hybrid take on Trip Advisor and Groupon - providing both reviews and deals at a time when they barely had internet. “I didn’t realise how difficult it was to get customers. I talked to lots of shops in the area and tried to sign them on, but it didn’t take off. I wouldn’t have done it if I knew what I know now - but I was a hustler.”

As Chen’s friends and volunteers for his project went on to land lucrative jobs, working at Google and jetting off to America, he felt his educational journey wasn’t finished yet. He came to the UK to do an advanced software engineering Master’s at King’s College London and a few months in, took on a part-time role creating a prototype for a startup.

“Not many people were working on startups in the early 2000s, so it gave me a window into how they did work in the UK. After graduation I worked at London School of Economics (LSE). At the time you needed visa sponsorship to stay in the UK, so the job gave me that security and I had the spare time to write software.”

Reigniting the founder flame

Yet Chen’s entrepreneurial spirit hadn’t left him, so he eventually left LSE. “I always wanted to start things. It’s a thrill. I’m not an area expert, so I like to build something from scratch for others and see it be used by others.”

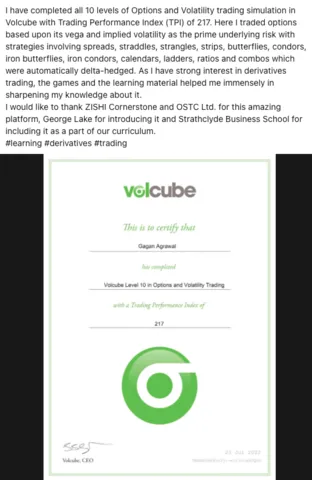

And by chance, Chen came across his next venture. His co-founder, a semi-retired financial trader, was writing a book about getting graduates into trading firms. “He needed software to put this vision into reality. I did a trial project and along with another co-founder, we became Volcube.”

Volcube was eventually acquired by the company they went into a joint venture with. For Chen, this was a great learning opportunity to have seen a startup through to exit. Fortunately for him, it was a smooth exit at the end of a 10-year journey that had been filled with twists and turns. “There was no drama in the exit and was a straightforward acquisition because of the prior joint venture.”

After going on to work for two more companies, Wise and Bondsmith respectively, Chen was at a crossroads and focusing on what the next ten years would bring.

Investing in being an investor

“I was very interested in venture-backed businesses. I worked for a scale-up and spoke to the investors there, but they were late-stage. I’ve done 80-100 angel investments, mostly crowdsourced and found it interesting to receive investor updates and see how others approached business.”

After ruling out an MBA, Chen’s curiosity led him to an investor education program ready to launch: Newton Venture Program. He monitored the initiative, holding out for announcements for the in-person Newton Fellowship Program.

“I submitted my application and was really looking forward to it. I didn’t think twice about what to expect, I just wanted to get there and learn.

“On the first day of the program, I still didn’t have any set hopes - I didn't know anything about venture capital as a profession, just a lot about those who take from the investors! I went in with a beginner’s mindset.

“It was a worthwhile investment. I certainly didn’t expect the network that was created, the calibre of attendees or the quality of teaching - it was superb. I’d never been to London Business School and this gave me access to elite executive education teaching.”

Reflecting on the program content, Chen enjoyed the dynamics of the lectures and group exercises and asking challenging questions throughout. And despite managing energy levels over three intense days (likened to partying three days in a row!), Chen enjoyed the environment that was created.

“We had great chemistry as a group, but also with the professors. Our discussions were lively and it was so enjoyable to listen to the professors as well as take part in the discussions. To really enjoy it, you have to participate. But no question is stupid and by the end, everyone was very relaxed to express their opinions. I appreciated a lot of the questions as they were coming from blind spots for me. I care a lot about diversity in thinking, so I made the most of having this diverse group and participating in a meaningful way.”

Chen may now be a Newton Fellowship graduate but his learning is far from over as he leans into the cohort as a support group.

“The standout feature of Newton Fellowship program is the group of inspiring people that I have meaningful conversations with. Some of the decisions I’m making now are influenced by that group of people. They’re high-achieving with original and authentic thinking. That was a completely unexpected part of the program. If you want exposure, this is the program for you; choose this over an MBA. I didn’t apply for anything else.”

Next steps

Between modules two and three of the Fellowship program, Chen started a new company, FABR. “I started something new because I was genuinely inspired by the cohort. You need to surround yourself with people you like, not just at a practical level, but at a direction-setting level.

“My mission is to create a viable business and also have a watchful eye on how they interact together. It’s real-world learning. I want to see the exit. I want to work with the investors and see their approaches. You need to have a track record so I’ll carry on angel investing on the side, which I really enjoy. I think this will make setting up a fund easier. There’s no way I could have done this plan and have these goals without Newton.”

Does the Fellowship sound like the right program for you? Take a look here.